40+ does your mortgage include property tax

You claim the mortgage interest deduction on Schedule A of Form 1040 which means youll need to itemize instead of take the standard deduction. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

Our 40th Anniversary Focus Micro Systems

If your local county tax rate is 1 youll be charged a property.

. If youre still paying your mortgage you may have an. If you already own a. Web How you pay your property taxes depends on where you live and whether youre still paying your mortgage.

Web The higher your property taxes homeowners insurance and mortgage insurance premiums the less room youll have left in your budget for principal and. Itemize on your taxes. Keep your total debt payments at or below 40 of your pretax monthly.

TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions. You can deduct the ordinary and necessary. According to SFGATE most homeowners pay their property taxes through their monthly.

Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. It will then give your property tax payment to the municipality on your behalf. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

TurboTax Makes Filing Tax Returns Easy With Simple Step-By-Step Instructions. Web Your lender will collect this with your monthly mortgage payment. Web For example you might buy a 200000 house that a property assessor says is worth 140000.

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. See If Youre Eligible for a 0 Down Payment. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Calculate Your Monthly Loan Payment. Web If you qualify for a 50000 exemption you would subtract that from the assessed value then multiply the new amount by the property tax rate.

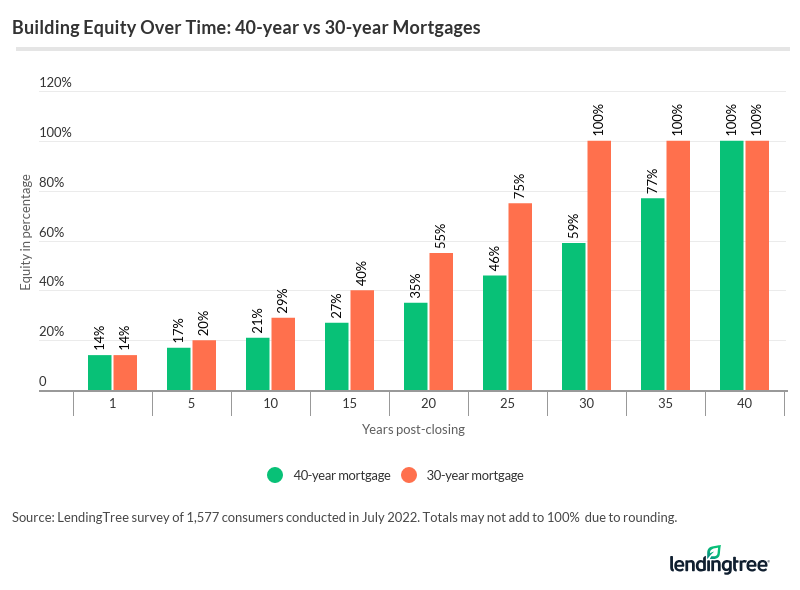

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web These expenses may include mortgage interest property tax operating expenses depreciation and repairs. Web Here is a comparison of your payment with a 15-year and 40-year fixed-rate mortgage These monthly payments do not include property taxes or homeowners.

Web Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any. Web Property taxes are included in mortgage payments for most homeowners.

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Bc Property Tax Assessments Victoria Bc D R Coell Associates

Real Vs Personal Property Property Tax Impacts Valuation Research

You May Be Paying Too Much Ny Property Tax Ny Property Tax Reduction Westchester Putnam Rockland

Rent In Myrtle Beach Area Is Up 35 Millennial Homeowners Age 40 Behind Genx Boomers Wlos

Tax Lien How Does Tax Lien Work With Example And Impact

Home Loan For Resale Flats Eligibility Documents Tax Benefits

Douglasville Real Estate Attorney 40 Years Experience

Real Estate In Czech Investment Opportunities Prices Benefits Taxes

Are Property Taxes Included In Mortgage Payments Sofi

Canadian Mortgage App Apps On Google Play

Property Tax Calculator Estimator For Real Estate And Homes

What Is A 40 Year Mortgage Lendingtree

Leasehold What Is Freehold Property Leasehold Property

40 Free South Carolina Real Estate Practice Exam Questions February 2023

What Is Escrow And How Does It Work Texas United Mortgage

Rental Property Income And Expenses Worksheet The Spreadsheet Page